Skip the Government Marketplace: How Private PPO Plans Actually Work

Fast guide to non-Marketplace Private PPOs—how they bill, who they fit, and what to verify first. We’ll confirm your doctors, compare options, and show clear costs.

Skip the Government Marketplace: How Private PPO Plans Actually Work

Prefer private, licensed-access coverage? Here’s the fast, practical guide—what it is, how it bills, and how to check if it fits your doctors, travel, and budget.

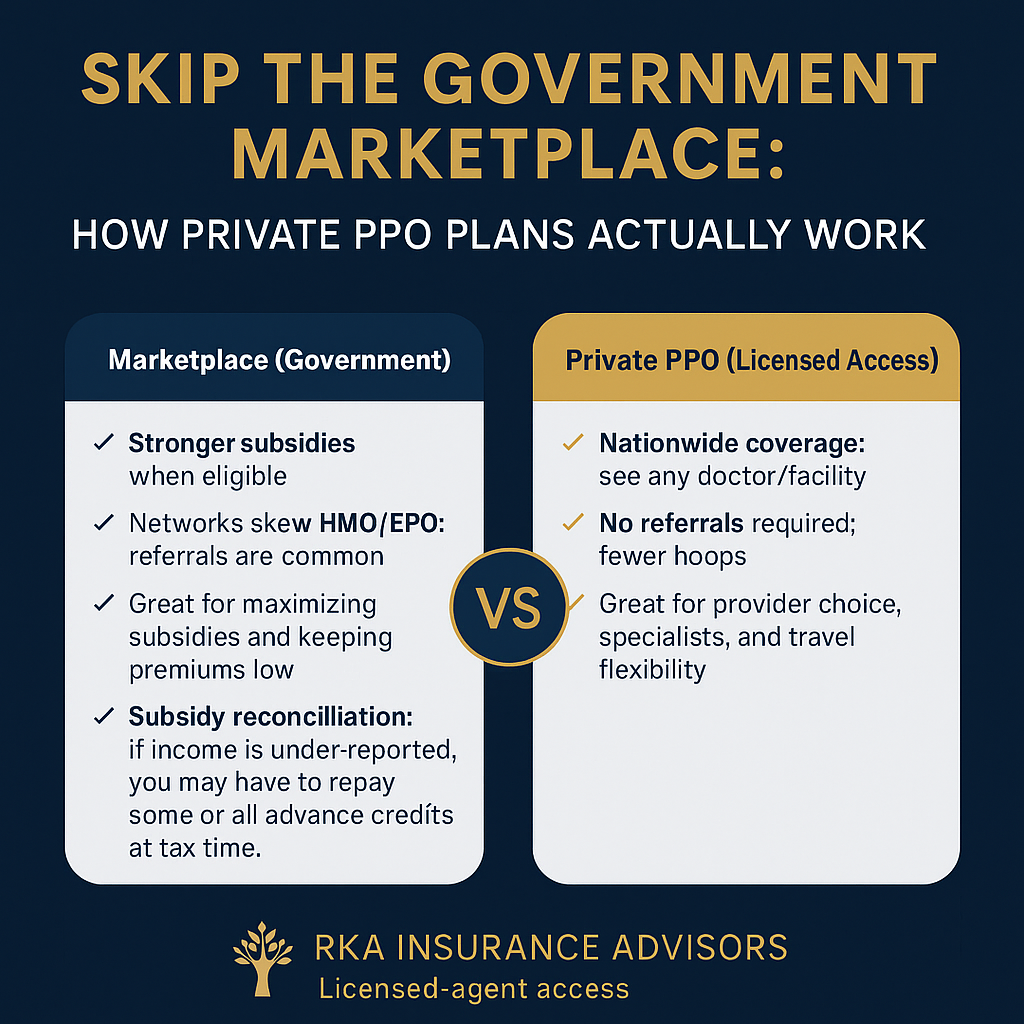

Why some people skip the Marketplace

Common reasons

- Keep specific doctors/hospitals. Many Marketplace options are HMO/EPO with referrals.

- Travel flexibility. Want nationwide, not just local networks.

- Fewer gatekeepers. Prefer no referrals for specialists or imaging.

- Income too high for meaningful subsidies—or you don’t want tax-credit involvement.

Balanced reality check

- If your income qualifies, Marketplace can be the cheapest route.

- Credits reconcile on your tax return; under-reporting income can create payback.

- Private PPOs skip subsidies entirely—pricing is based on age, ZIP, benefits, and network.

Bottom line: Choose based on doctors + travel + total cost, not labels. We verify both paths before you switch.

How Private PPO actually works

Private PPO (Licensed Access)

- Nationwide PPO access in eligible networks—keep your specialists and preferred hospitals.

- No referrals for specialists (typical), fewer hoops to schedule care.

- Enroll through a licensed agent; options vary by state and carrier.

- Premiums aren’t tied to ACA income credits.

What to verify first

- Your exact doctors and facilities are in-network (we check for you).

- Copays vs coinsurance on high-ticket items (imaging, outpatient surgery).

- Prescription tiers and any prior-auth on key meds.

- Out-of-pocket maximum is a number you can live with.

What drives price (non-subsidized)

The big levers

- Age rating for adults; kids usually add less than another adult.

- ZIP/county + network breadth.

- Deductibles, coinsurance, copays, and the out-of-pocket max.

Ways to keep it efficient

- Don’t overbuy—match benefits to how you actually use care.

- Choose networks that include your real providers (not just brand names).

- Use generics when clinically appropriate; we’ll check formulary tiers.

Who typically chooses Private PPO

Strong fit

- Self-employed/1099 families who want broad doctor choice.

- Frequent travelers or multi-state households.

- People who dislike referral bottlenecks.

Maybe not a fit

- Households whose main goal is max subsidies and the lowest possible premium.

- Anyone who does not have specific providers to keep and rarely needs out-of-area care.

Want the best non-Marketplace fit in your ZIP?

We’ll verify your doctors and meds, compare PPO options, and show clear costs. No pressure—just answers.

FAQ

Are Private PPOs the same as Marketplace plans?

No. These are non-Marketplace plans available via licensed-agent access. Pricing isn’t tied to ACA tax credits.

Do Private PPOs need referrals?

Typically no—one of the big reasons people switch. We’ll confirm rules for your exact network.

Will I owe taxes if I’m not using subsidies?

Private PPOs don’t use ACA credits, so there’s no subsidy reconciliation. On the Marketplace, credits reconcile—if income is higher than estimated, payback can apply. Ask your tax pro for details.

How do I know if my doctor is covered?

Send your provider list. We check contracts and book of business, not just “find-a-doc” directories.

How do we start?

Share your doctors, prescriptions, and budget. We’ll map your options and enroll you quickly and compliantly.

This overview is educational, not tax or legal advice. Plan availability and rules vary by state and carrier. Eligibility and enrollment subject to underwriting/plan terms where applicable.