Starting a New Business? Here's Your Health Insurance Game Plan

Starting a new business with unpredictable income? Private underwritten PPOs eliminate subsidy reconciliation hassles and may offer plans with deductibles as low as $0—often beating ACA high-deductible plans with healthier risk pools and supplemental coverage.

Starting a New Business? Here's Your Health Insurance Game Plan

Fast take: Left your job to start a business? Your health insurance strategy matters as much as your business plan. With unpredictable first-year income, private underwritten PPOs eliminate subsidy reconciliation hassles and may offer plans with deductibles as low as $0—often beating high-deductible ACA plans with better networks and lower total costs.

Just went full-time on your business?

We'll compare COBRA, ACA, and private PPO options—and verify your doctors stay covered while you build.

Get Free Quotes Book a CallYour coverage options when starting a business

COBRA (Bridge Option)

✓ Keep your old employer plan

✓ Same doctors and networks

✗ Usually most expensive

✗ Time-limited (18 months max)

ACA Marketplace

✓ May be cheapest with subsidies

✓ Loss of job = Special Enrollment

✗ Often HMO/EPO networks

✗ Income reconciliation at tax time

✗ High deductibles ($7,000-$9,000+)

Private Underwritten PPO

✓ May qualify for deductibles as low as $0

✓ Nationwide PPO access

✓ Year-round enrollment

✓ No income reporting

✓ Healthier risk pools

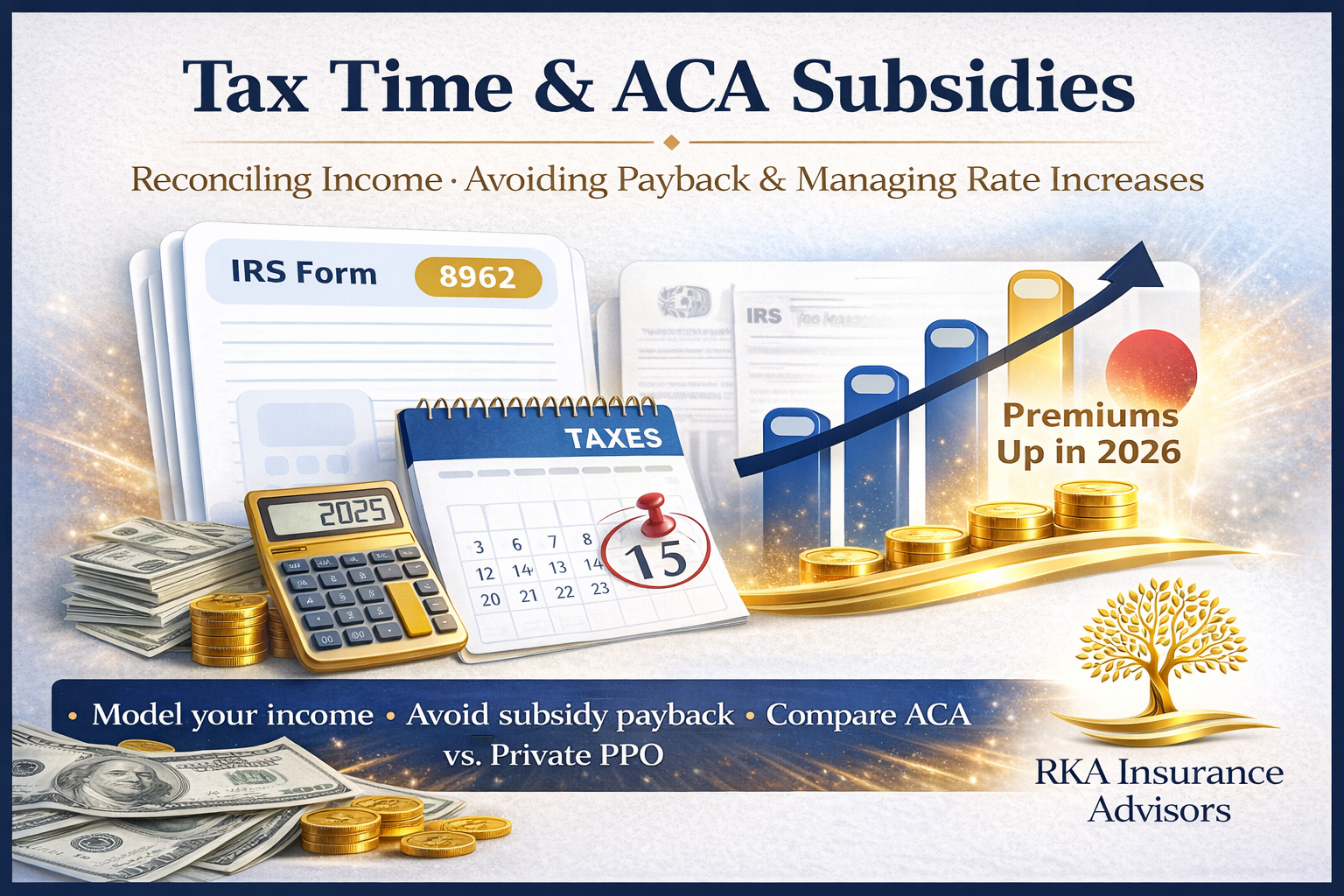

Why unpredictable income is a nightmare with ACA subsidies

The income estimation trap

When you enroll in ACA, you estimate your 2026 income in advance. First-year business? You're guessing.

✗ Estimate too low → subsidy payback at tax time

✗ Estimate too high → overpay premiums all year

✗ Business takes off mid-year? You owe thousands back

Private PPO eliminates the guessing game

Your premium is based on age, ZIP, and plan—not income.

✓ Make $50k or $500k? Premium stays the same

✓ No Form 8962 reconciliation at tax time

✓ Budget with confidence from day one

Why private underwritten PPOs beat high-deductible ACA plans

Many entrepreneurs think high-deductible Marketplace plans are their only affordable option. That's rarely true for healthy business owners.

ACA high-deductible plans

✗ $7,000-$9,000+ deductibles common

✗ You pay 100% until deductible is met

✗ Risk pool includes all applicants (healthy + unhealthy)

✗ Often HMO/EPO with referral requirements

✗ Premium jumps if income rises

Private underwritten PPOs

✓ May qualify for deductibles as low as $0

✓ Copays often start immediately (office visits, Rx)

✓ Risk pool = healthy small business owners/employees

✓ Nationwide PPO networks, no referrals

✓ Premium never changes with income

The risk pool advantage: Why private plans cost less for healthy entrepreneurs

ACA Marketplace risk pools

Guaranteed issue = everyone accepted regardless of health

Risk pool includes:

• Healthy applicants

• Chronic conditions

• High-cost ongoing treatments

Result: Higher premiums spread across everyone, including you

Private underwritten risk pools

Medical underwriting = healthier risk pool through association memberships

Risk pool includes:

• Healthy business owners

• Small business employees

• Self-employed professionals

Result: Lower premiums for healthy applicants, better benefits, lower deductibles

Supplemental coverage: Offsetting out-of-pocket costs

Even with low-deductible private PPOs, you can further reduce financial risk with supplemental coverage:

Hospital indemnity insurance

Pays cash benefit per day of hospitalization

✓ Use cash for deductibles, copays, or lost income

✓ Low monthly cost ($30-$80/month typical)

Accident insurance

Covers ER visits, urgent care, broken bones, imaging

✓ Pays lump sum or per-service benefits

✓ Complements your major medical plan

Critical illness insurance

Lump-sum payment if diagnosed with covered condition (heart attack, stroke, cancer)

✓ Use for medical bills, travel, mortgage—anything

✓ Peace of mind for catastrophic events

Strategy: Layer your protection

Private PPO with low deductible + hospital indemnity ($500/day) = near-zero financial risk

Total monthly cost often less than ACA high-deductible plan alone

Why entrepreneurs choose private PPO plans

No income reconciliation headaches

Your premium doesn't change when your business revenue fluctuates. No Form 8962, no tax-time surprises, no subsidy payback.

Travel-friendly nationwide networks

Client meetings in Austin? Conference in Denver? PPO access means you're covered wherever business takes you—no network restrictions.

Direct specialist access

No primary care referrals. No waiting weeks for authorization. See specialists when you need them without bureaucratic delays.

Lower total annual costs

Low-deductible PPO often costs less annually than $8,000 deductible ACA plan when you factor in total out-of-pocket exposure.

Common mistakes new business owners make

❌ Staying on COBRA too long

COBRA is expensive and time-limited. It's a bridge, not a long-term solution. Compare alternatives within 60 days.

❌ Underestimating income for subsidies

Business takes off? You'll owe subsidy money back at tax time. Estimate conservatively or skip subsidies entirely with private PPO.

❌ Accepting high deductibles as inevitable

ACA high-deductible plans aren't your only option. Private underwritten PPOs may offer plans with deductibles as low as $0 for healthy applicants.

❌ Not considering supplemental coverage

Hospital indemnity and accident insurance can eliminate remaining out-of-pocket exposure for less than $100/month.

Decision guide: Which option fits your business?

Choose ACA Marketplace if...

✓ Your first-year income will be very low (under $35k individual)

✓ You qualify for strong subsidies and cost-sharing reductions

✓ Your income is stable and predictable

✓ You're comfortable with high deductibles and HMO networks

✓ You don't mind annual tax reconciliation

Choose Private Underwritten PPO if...

✓ Your income is variable or growing (startup revenue unpredictable)

✓ You're healthy and pass medical underwriting

✓ You want lower deductibles and immediate copays

✓ You travel frequently for business

✓ You prefer nationwide PPO access with no referrals

✓ You want to avoid subsidy reconciliation at tax time

Your launch timeline: Health insurance edition

Before you leave your job

✓ Document your last day of employer coverage

✓ Get COBRA election notice

✓ List your current doctors and prescriptions

✓ Estimate your Year 1 business income range (low and high scenarios)

First 60 days after leaving

✓ Compare COBRA vs ACA vs private PPO costs and deductibles

✓ Verify provider networks for all options

✓ Get quotes for supplemental coverage (hospital indemnity, accident)

✓ Enroll in your long-term solution before Special Enrollment window closes

First year in business

✓ Track actual income monthly (if on ACA, update estimates)

✓ Keep records for self-employed health insurance tax deduction

✓ Set aside emergency fund for deductibles and out-of-pocket costs

✓ Review supplemental coverage needs as business stabilizes

Annual review

✓ Reassess coverage during Open Enrollment (or anytime with private PPO)

✓ Compare costs as your income stabilizes

✓ Verify doctors are still in-network

✓ Adjust deductible level based on actual business cash flow

How RKA helps entrepreneurs

Fast transition planning

We map your options before your last day of work—COBRA bridge strategies, Special Enrollment timing, and private PPO alternatives with accurate underwriting pre-screening.

Network verification

We confirm your doctors and hospitals are in-network across all options—ACA, private PPO, and supplemental plans—before you commit.

Total cost analysis

We model multiple income scenarios and compare: premiums + deductibles + expected usage + supplemental coverage = your true annual cost.

Supplemental layering strategy

We show you how hospital indemnity, accident, and critical illness coverage can eliminate remaining out-of-pocket exposure affordably.

Launching your business? Lock your health insurance first.

We'll compare COBRA, ACA, and private underwritten PPO options—verify your doctors—and layer supplemental coverage to eliminate financial risk.

Get Free Quotes Book a CallQuick FAQs

Why is private underwritten PPO cheaper than ACA high-deductible if I'm healthy?

Risk pool matters. ACA pools include everyone regardless of health, spreading costs across healthy and unhealthy. Private underwritten plans pool healthy small business owners, employees, and self-employed professionals through association memberships, resulting in lower premiums and better benefits.

What if my business income is unpredictable?

Private PPO eliminates the guessing game. Your premium is based on age and ZIP—not income. Make $50k or $500k, your premium stays the same. No subsidy reconciliation, no Form 8962, no tax-time surprises.

How does supplemental coverage work with my major medical plan?

Supplemental policies (hospital indemnity, accident, critical illness) pay cash benefits directly to you—use the money for deductibles, copays, lost income, or anything else. They stack on top of your major medical plan to eliminate financial risk.

For education only; consult a tax professional for deduction advice. Eligibility for private underwritten plans subject to medical underwriting. Benefits vary by carrier and state. Always review official plan documents.

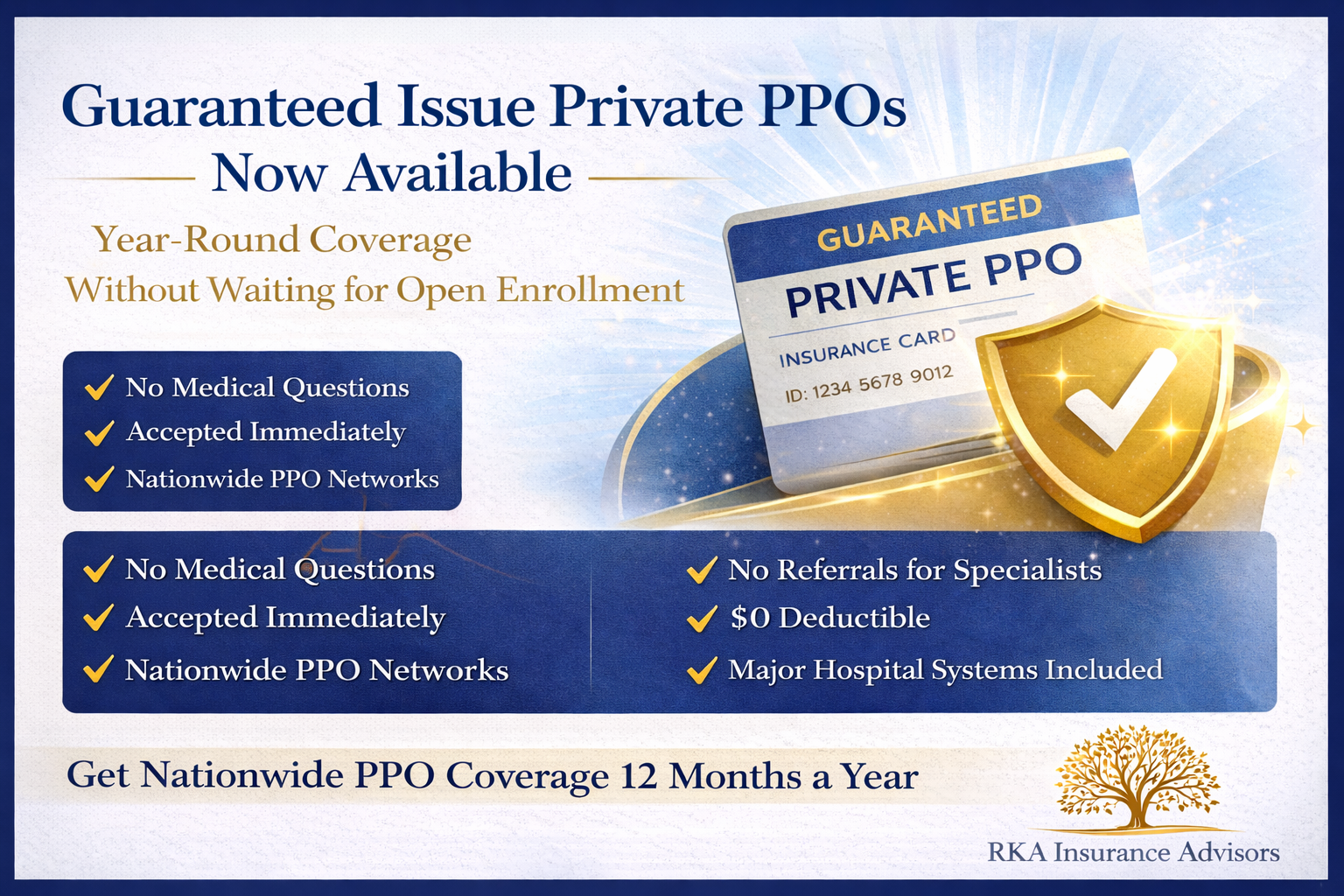

Guarantee Issue Private PPOs: Year-Round Coverage Without Medical Underwriting | RKA

Guarantee issue private PPOs now available in select markets—year-round enrollment, nationwide networks, no medical underwriting required. Perfect if you missed Open Enrollment or need coverage with pre-existing conditions. We check availability in your ZIP.

Guarantee Issue Private PPOs Now Available – Year-Round Coverage Without Waiting for Open Enrollment

Fast take: New guarantee issue private PPO options are available in select markets—year-round enrollment, broad nationwide networks, and no medical underwriting required. If you need coverage outside Open Enrollment and don't have a Special Enrollment Period, this may be your path. We'll verify providers and show clear costs before you commit.

Need coverage now without waiting for Open Enrollment?

We'll confirm if guarantee issue PPOs are available in your ZIP, verify your doctors, and enroll you quickly.

Get Free Quotes Book a CallWhat makes guarantee issue PPOs different

For years, private PPO plans required medical underwriting—health questions that could result in denial or exclusions if you had pre-existing conditions. Guarantee issue private PPOs solve this problem by combining the best features of ACA Marketplace plans (no medical questions, guaranteed acceptance) with the advantages of private PPO networks (broader access, fewer restrictions, year-round availability).

Guarantee Issue

✓ No medical questions

✓ No health exams

✓ Cannot be denied

✓ Pre-existing conditions covered

✓ Coverage starts immediately

PPO Network Benefits

✓ Nationwide provider access

✓ No referrals for specialists

✓ Out-of-network coverage

✓ Major hospital systems included

✓ Travel-friendly coverage

Year-round enrollment

These plans are available outside the standard November-January Open Enrollment period. You can apply and start coverage any month of the year without needing a Qualifying Life Event.

Perfect if you:

✓ Missed the January 15 deadline

✓ Don't have a qualifying life event

✓ Need coverage immediately

✓ COBRA is too expensive

✓ Want to switch plans mid-year

Great for:

✓ Frequent travelers

✓ Multi-state households

✓ Specific doctor requirements

✓ Higher income (no subsidies)

✓ Pre-existing conditions

How guarantee issue PPOs compare

| Feature | Guarantee Issue PPO | ACA Marketplace | Underwritten PPO |

|---|---|---|---|

| Medical questions | None | None | Yes (can deny) |

| Enrollment window | Year-round | Open Enrollment only | Year-round (if approved) |

| Network type | Nationwide PPO | Often HMO/EPO | Nationwide PPO |

| Subsidies | No | Yes (if eligible) | No |

| Pre-existing conditions | May have exclusions & limits | Covered day 1 | Covered if approved & disclosed |

Simple next steps

1. Check availability

Not offered in all states or ZIP codes. We'll confirm immediately if these plans are available in your area.

2. Verify providers

Send your doctor list. We'll check network participation before you commit—even PPOs don't cover every provider.

3. Compare costs

We'll show total annual cost: premiums + deductibles + expected usage across all your options.

4. Enroll fast

Most plans start on the 1st or 15th of the month. We'll time your application to avoid coverage gaps.

Quick FAQs

Are guarantee issue PPOs available in all states?

No—availability varies by carrier and market. We'll check your specific ZIP code and confirm which options exist in your area.

How do premiums compare to Marketplace plans?

Often similar to unsubsidized Marketplace plans, but with PPO flexibility instead of HMO/EPO restrictions. If you qualify for Marketplace subsidies, the subsidized plan will almost always be cheaper.

Can I switch from a Marketplace plan to a guarantee issue PPO mid-year?

Yes, if you're willing to give up subsidies (if you have them). We'll compare total costs—including lost subsidies—before you make the switch to ensure it makes financial sense.

What if I have a serious pre-existing condition?

Guarantee issue means exactly that—no one can be turned down. Pre-existing conditions may have wait periods or exclusions.

For education only; availability and benefits vary by carrier, state, and ZIP code. Always review official plan documents.

MISSED ENROLLMENT? WHAT'S NEXT - PRIVATE OPTIONS

Missed Open Enrollment? Special Enrollment Periods after life events and year-round private PPO options can get you covered outside the Jan 15 deadline. We check your eligibility, verify doctors, and compare ACA vs private PPO options fast.

Missed Open Enrollment? Here's What's Next – Private PPO Options & Special Enrollment Periods

Fast take: Missed the January 15 Open Enrollment deadline? You still have options. Qualify for a Special Enrollment Period after a life event, or—if eligible—apply for a private, medically underwritten PPO that can start any month. We'll verify doctors, prescriptions, and timing to avoid gaps.

Missed Open Enrollment? Let's find your path to coverage.

We'll check if you qualify for an SEP, compare income-based options, and review private PPO alternatives—then enroll you quickly.

Get Free Quotes Book a CallYour coverage options after January 15

Missing Open Enrollment doesn't mean you're stuck without coverage for the entire year. There are legitimate pathways to get health insurance outside the standard enrollment window—you just need to know which one applies to your situation.

Path #1: Special Enrollment Period (SEP)

If you've experienced a Qualifying Life Event (QLE), you can enroll in Marketplace coverage outside Open Enrollment. The government recognizes that life doesn't wait for enrollment windows, and certain events create immediate coverage needs.

Common Qualifying Life Events:

- Loss of coverage: Losing employer coverage, aging off a parent's plan at 26, COBRA ending, losing Medicaid eligibility

- Household changes: Marriage, divorce, legal separation, death of a spouse

- New dependents: Birth, adoption, foster care placement

- Residence changes: Moving to a new ZIP code or state with different plan options (not just moving addresses within the same service area)

- Income changes: Gaining or losing eligibility for premium tax credits or cost-sharing reductions

- Other coverage changes: Gaining citizenship, release from incarceration, enrollment errors by the Marketplace or insurer

Timing matters: Most SEPs last 60 days from the date of your qualifying event. You'll need documentation (termination letter, marriage certificate, birth certificate, lease agreement, etc.) to prove your QLE.

We'll help you determine if your situation qualifies, gather the right documentation, and set the correct effective date so there are no gaps in coverage.

Path #2: Private, medically underwritten PPO

Private PPOs operate outside the ACA Marketplace system and are available year-round for applicants who pass medical underwriting. These plans offer significant advantages for the right people:

Key features of private PPOs:

- Year-round enrollment: Apply any month—no need to wait for Open Enrollment or have a qualifying life event

- Broader networks: Often nationwide PPO access with major carriers, great for travelers or multi-state households

- No referrals: Typically direct access to specialists without PCP gatekeeping

- Flexible start dates: Many carriers offer 1st or 15th of the month effective dates after approval

- Competitive pricing: For healthy applicants, premiums can be lower than unsubsidized Marketplace plans

Medical underwriting requirements:

Unlike ACA Marketplace plans (which are guaranteed issue regardless of health status), private PPOs require you to answer health questions. Approval depends on:

- Pre-existing conditions and their severity

- Current medications and dosages

- Recent hospitalizations or surgeries

- Overall health profile and risk factors

We pre-screen applications quickly (usually within 24 hours) to let you know if you're likely to be approved before you formally apply. This saves time and avoids unnecessary declinations on your record.

Path #3: Income-based Marketplace options

In certain situations, changes in income can create Special Enrollment Period eligibility, even without a traditional qualifying life event. This typically applies when:

- Your income drops below 150% of the Federal Poverty Level and you become newly eligible for enhanced subsidies

- You gain or lose access to employer coverage due to income changes affecting your job status

- You move and your new location affects your subsidy eligibility

If you're self-employed or have variable income (1099 contractor, gig worker, commission-based), we can model your expected 2026 MAGI and determine if income-based SEP rules might apply.

How to decide which path fits you

Choose SEP if…

✓ You had a qualifying life event in the past 60 days

✓ You qualify for Marketplace subsidies

✓ You need guaranteed issue coverage regardless of health

✓ Your doctors are in Marketplace networks

Choose Private PPO if…

✓ You're in good health and can pass underwriting

✓ You want nationwide PPO access

✓ You don't qualify for meaningful subsidies

✓ You need coverage to start quickly

Consider short-term if…

✓ You need temporary coverage for 1-3 months

✓ You're between jobs or waiting for employer coverage

✓ You understand limited benefits and exclusions

✓ You're healthy and have minimal ongoing care needs

Simple coverage checklist

To get started, gather this information so we can move quickly:

- Your providers: Names and locations of your doctors, specialists, and preferred hospitals

- Current prescriptions: Medication names, dosages, and frequency

- QLE documentation (if applicable): Termination letters, marriage certificates, birth certificates, lease agreements

- Target start date: When you need coverage to begin

- Health summary: Major conditions, recent surgeries, current treatments (for private PPO pre-screening)

We'll verify which path you qualify for, confirm your providers are in-network, model total annual costs, and enroll you with the correct effective date.

Quick FAQs

How fast can coverage start?

Marketplace SEP plans typically start the 1st of the month following enrollment (if you enroll by the 15th). Private PPOs can start on the 1st or 15th after underwriting approval, depending on the carrier—usually 3-7 business days.

What if I don't have a qualifying life event?

If you don't qualify for an SEP, private PPO options may still be available if you pass medical underwriting. We'll pre-screen your health profile and let you know quickly if it's a viable path.

Can you confirm my doctors are in-network?

Yes. Send us your provider list (names, specialties, locations) and we'll verify participation across both Marketplace SEP plans and private PPO networks before you enroll.

What if I get declined for a private PPO?

We'll explore other options immediately—checking if you qualify for any SEP pathways, Medicaid eligibility, or short-term coverage as a bridge until next Open Enrollment.

For education only; eligibility, plan availability, and dates vary by state and carrier. Always review official plan documents.

New to Texas? Health Insurance—Fast Guide (Marketplace vs Private PPO)

Texas health insurance, made simple: Marketplace credits vs Private PPO, how networks differ, start dates, and what to verify first. We’ll check your doctors and show clear costs.

New to Texas? Health Insurance—Fast Guide (Marketplace vs Private PPO)

Just moved to TX? Here’s how coverage works, what proof you’ll need, and how to keep your doctors. We’ll verify providers and show clear costs—no pressure.

- Can be cheapest if your income qualifies for credits.

- Many plans are HMO/EPO; referrals are common.

- Options vary by county/ZIP.

- Move = special enrollment (time-limited). Credits reconcile at tax time.

- Nationwide PPO access when eligible; keep key doctors/hospitals.

- Typically no referrals; fewer hoops for specialists.

- Pricing isn’t tied to ACA income credits.

- Good for travel, provider choice, and specialist access.

What to do first (takes 5 minutes)

1) Gather quick proof

- New TX address (lease, closing docs, utility, USPS change).

- Prior coverage details if switching.

2) List providers & meds

- Doctors, specialists, hospitals you want to keep.

- Current prescriptions (name + dosage).

3) Decide priorities

- Lowest premium vs. broad network.

- Referrals OK or prefer no referrals?

- Travel out of state?

What drives cost in Texas

Marketplace

- Income & household size (for tax credits).

- Plan level & network (HMO/EPO common).

- County—options can change across county lines.

Private PPO

- Age, ZIP, benefit level, and network size.

- No ACA credits; premiums are straightforward.

- Great when keeping providers is the priority.

Simple decision guide

Choose Marketplace if…

- Your income qualifies for strong credits.

- You’re OK with HMO/EPO rules & referrals.

- Lowest premium is the top priority.

Choose Private PPO if…

- You want broad, often nationwide PPO access.

- You prefer no referrals to see specialists.

- Keeping specific doctors/hospitals matters most.

New to Texas? Let’s lock the best fit in your ZIP.

We’ll verify your doctors and meds, compare Marketplace vs Private PPO, and show clear costs. No pressure—just answers.

FAQ for recent Texas moves

Do I get a special enrollment window when I move to Texas?

What proof of my move do I need?

When will coverage start?

Can I keep my current doctors?

What if I’m coming from COBRA?

This overview is educational, not tax or legal advice. Availability and rules vary by carrier and county. Eligibility and enrollment subject to plan terms.

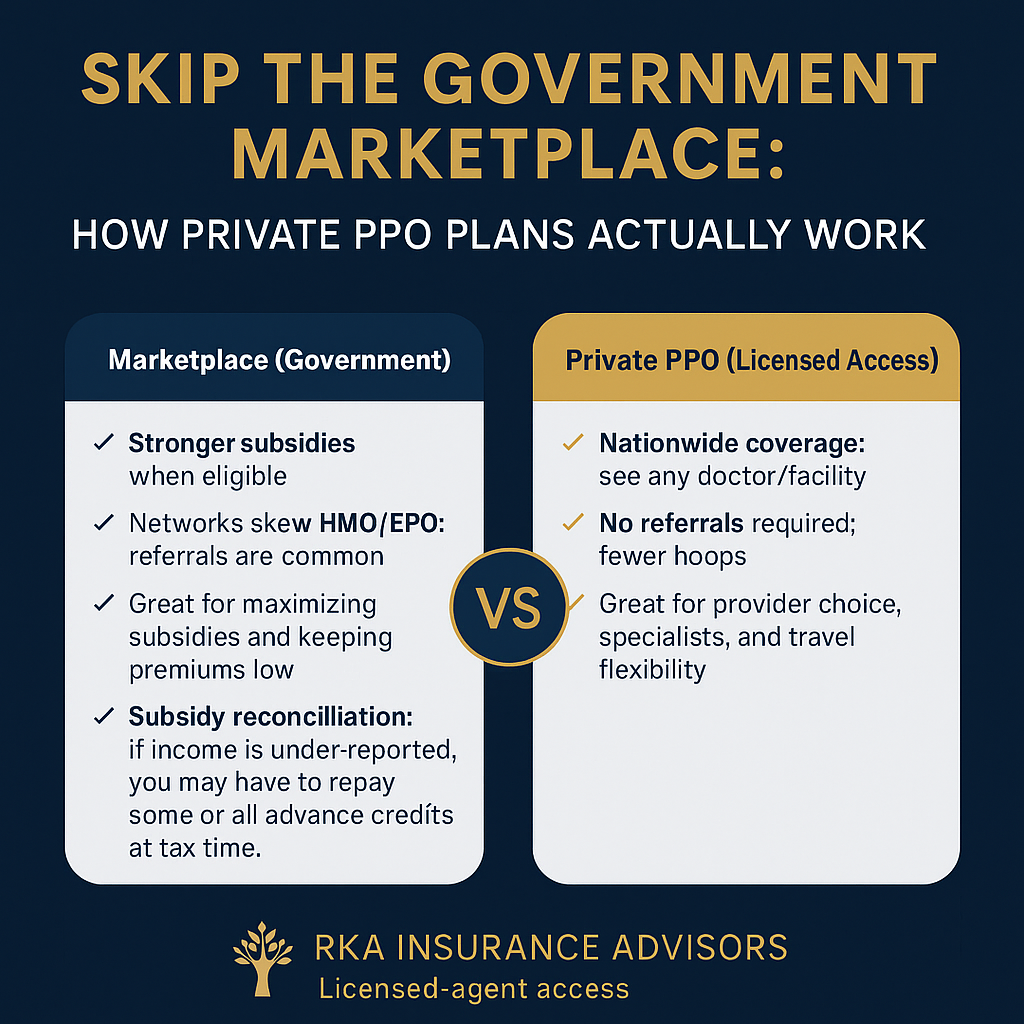

Skip the Government Marketplace: How Private PPO Plans Actually Work

Fast guide to non-Marketplace Private PPOs—how they bill, who they fit, and what to verify first. We’ll confirm your doctors, compare options, and show clear costs.

Skip the Government Marketplace: How Private PPO Plans Actually Work

Prefer private, licensed-access coverage? Here’s the fast, practical guide—what it is, how it bills, and how to check if it fits your doctors, travel, and budget.

Why some people skip the Marketplace

- Keep specific doctors/hospitals. Many Marketplace options are HMO/EPO with referrals.

- Travel flexibility. Want nationwide, not just local networks.

- Fewer gatekeepers. Prefer no referrals for specialists or imaging.

- Income too high for meaningful subsidies—or you don’t want tax-credit involvement.

- If your income qualifies, Marketplace can be the cheapest route.

- Credits reconcile on your tax return; under-reporting income can create payback.

- Private PPOs skip subsidies entirely—pricing is based on age, ZIP, benefits, and network.

How Private PPO actually works

- Nationwide PPO access in eligible networks—keep your specialists and preferred hospitals.

- No referrals for specialists (typical), fewer hoops to schedule care.

- Enroll through a licensed agent; options vary by state and carrier.

- Premiums aren’t tied to ACA income credits.

- Your exact doctors and facilities are in-network (we check for you).

- Copays vs coinsurance on high-ticket items (imaging, outpatient surgery).

- Prescription tiers and any prior-auth on key meds.

- Out-of-pocket maximum is a number you can live with.

What drives price (non-subsidized)

The big levers

- Age rating for adults; kids usually add less than another adult.

- ZIP/county + network breadth.

- Deductibles, coinsurance, copays, and the out-of-pocket max.

Ways to keep it efficient

- Don’t overbuy—match benefits to how you actually use care.

- Choose networks that include your real providers (not just brand names).

- Use generics when clinically appropriate; we’ll check formulary tiers.

Who typically chooses Private PPO

Strong fit

- Self-employed/1099 families who want broad doctor choice.

- Frequent travelers or multi-state households.

- People who dislike referral bottlenecks.

Maybe not a fit

- Households whose main goal is max subsidies and the lowest possible premium.

- Anyone who does not have specific providers to keep and rarely needs out-of-area care.

Want the best non-Marketplace fit in your ZIP?

We’ll verify your doctors and meds, compare PPO options, and show clear costs. No pressure—just answers.

FAQ

Are Private PPOs the same as Marketplace plans?

Do Private PPOs need referrals?

Will I owe taxes if I’m not using subsidies?

How do I know if my doctor is covered?

How do we start?

This overview is educational, not tax or legal advice. Plan availability and rules vary by state and carrier. Eligibility and enrollment subject to underwriting/plan terms where applicable.