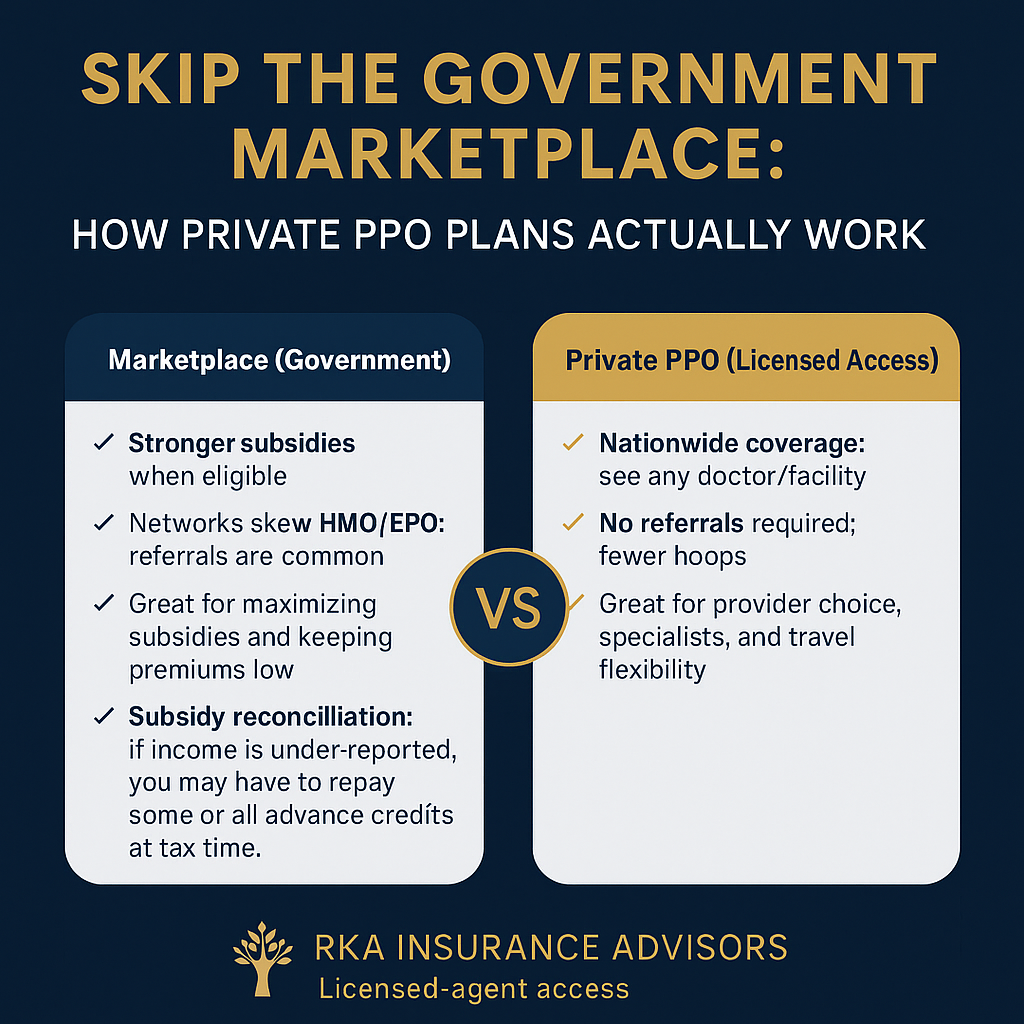

Skip the Government Marketplace: How Private PPO Plans Actually Work

Fast guide to non-Marketplace Private PPOs—how they bill, who they fit, and what to verify first. We’ll confirm your doctors, compare options, and show clear costs.

Skip the Government Marketplace: How Private PPO Plans Actually Work

Prefer private, licensed-access coverage? Here’s the fast, practical guide—what it is, how it bills, and how to check if it fits your doctors, travel, and budget.

Why some people skip the Marketplace

- Keep specific doctors/hospitals. Many Marketplace options are HMO/EPO with referrals.

- Travel flexibility. Want nationwide, not just local networks.

- Fewer gatekeepers. Prefer no referrals for specialists or imaging.

- Income too high for meaningful subsidies—or you don’t want tax-credit involvement.

- If your income qualifies, Marketplace can be the cheapest route.

- Credits reconcile on your tax return; under-reporting income can create payback.

- Private PPOs skip subsidies entirely—pricing is based on age, ZIP, benefits, and network.

How Private PPO actually works

- Nationwide PPO access in eligible networks—keep your specialists and preferred hospitals.

- No referrals for specialists (typical), fewer hoops to schedule care.

- Enroll through a licensed agent; options vary by state and carrier.

- Premiums aren’t tied to ACA income credits.

- Your exact doctors and facilities are in-network (we check for you).

- Copays vs coinsurance on high-ticket items (imaging, outpatient surgery).

- Prescription tiers and any prior-auth on key meds.

- Out-of-pocket maximum is a number you can live with.

What drives price (non-subsidized)

The big levers

- Age rating for adults; kids usually add less than another adult.

- ZIP/county + network breadth.

- Deductibles, coinsurance, copays, and the out-of-pocket max.

Ways to keep it efficient

- Don’t overbuy—match benefits to how you actually use care.

- Choose networks that include your real providers (not just brand names).

- Use generics when clinically appropriate; we’ll check formulary tiers.

Who typically chooses Private PPO

Strong fit

- Self-employed/1099 families who want broad doctor choice.

- Frequent travelers or multi-state households.

- People who dislike referral bottlenecks.

Maybe not a fit

- Households whose main goal is max subsidies and the lowest possible premium.

- Anyone who does not have specific providers to keep and rarely needs out-of-area care.

Want the best non-Marketplace fit in your ZIP?

We’ll verify your doctors and meds, compare PPO options, and show clear costs. No pressure—just answers.

FAQ

Are Private PPOs the same as Marketplace plans?

Do Private PPOs need referrals?

Will I owe taxes if I’m not using subsidies?

How do I know if my doctor is covered?

How do we start?

This overview is educational, not tax or legal advice. Plan availability and rules vary by state and carrier. Eligibility and enrollment subject to underwriting/plan terms where applicable.

2026 Open Enrollment Changes: What’s New, What’s Driving Cost, and What to Do Now

Major 2026 Open Enrollment updates: Premiums up, out-of-pocket limits higher, and subsidy extensions uncertain. Compare Marketplace vs Private PPOs before it’s too late.

Enrollment Help • Nov 5 • Written by Robert Adams

2026 Open Enrollment Changes: What’s New, What’s Driving Cost, and What to Do Now

Fast take:

The 2026 open enrollment is bringing significant shifts — premium hikes, higher out-of-pocket caps, and subsidy uncertainty all combine to change the game from previous years. If you’re qualifying for coverage for 2026, it’s time to compare [Marketplace](chatgpt://generic-entity?number=0) vs. private medically-underwritten PPOs vs. COBRA exit strategies and pick your right window **before the clock runs out**.

- • Premium filings show increases for 2026 in many states.

- • Max out-of-pocket limits are rising — you may pay more if you use care.

- • Subsidy changes are unconfirmed — if enhanced credits fade, your “net” cost could jump.

- • Not tied to federal subsidy legislation — pricing is independent.

- • Often broader PPO networks and fewer referral restrictions.

- • Eligibility required, but it’s a powerful option when Marketplace costs spike.

What’s new for 2026 open enrollment

The landscape has shifted in part due to macro-factors and in part due to policy. Here’s what’s driving the changes:

- Carrier cost-trend is higher → claims, drugs, and specialty care all escalate and carriers file accordingly.

- Higher out-of-pocket maximums → The yearly cap is creeping up again, meaning more financial risk for members.

- Subsidy uncertainty → If enhanced credits aren’t extended or phase down, even a stable income could leave you paying more.

- COBRA exposure remains extreme → If you’re losing employer coverage, staying on COBRA might cost more than shopping alternatives now.

What this means for you and your family

For example: a 45-year-old couple with two children saw a typical Bronze Marketplace renewal jump from $1,250 / mo in 2025 to around $1,650 / mo in 2026. The max out-of-pocket climbed from $8,700 to $10,000. That means:

- • You’ll pay a higher premium just to stay in the same segment.

- • If you or a family member use care early in the year, you’ll hit higher OOP sooner.

- • If subsidies are reduced, your net cost could rise again — even if your plan looked okay today.

That’s why we tell households: don’t renew blind. Compare Marketplace vs Private PPO vs COBRA alternative to see your real cost before you lock in.

What to do next: Your 3-step checklist

1) Submit your details

ZIP, ages, income estimate — so we can test all paths for you.

2) Verify your doctors & prescriptions

Network changes in 2026 are real. Let us check before you pick a plan.

3) Compare your three paths

Marketplace vs Private PPO vs COBRA exit — pick the one that fits your risk-level and timing.

Let’s lock the right 2026 plan for your ZIP.

We’ll run Marketplace vs Private PPO vs COBRA escape for your exact family, verify your doctors, and tell you which enrollment window you’re actually in.

Quick FAQs

Will I automatically see higher 2026-costs if I stayed in the same plan?

Often yes — even if your benefits didn’t change. Because premiums and OOP maximums are rising across the board.

What if enhanced subsidies get extended again?

Great if they are — but don’t bet on it. We prepare your plan assuming worst-case and then re-run if credits improve.

Can I switch mid-year if I pick wrong?

Maybe — but limited. That’s why we use a licensed advisor to match your timing, plan, and risk exposure before you enroll.

Robert Adams

RKA Insurance Advisors • Private & Marketplace Health Coverage • 561-806-9913 • robert@rkainsuranceadvisors.com

Time is Running Out: The Open Enrollment Deadline for Health Insurance Quotes is December 15th!

Open Enrollment 2026: Enroll by Dec 15 for Jan 1 or by Jan 15 for Feb 1. We’ll compare Marketplace vs Private PPO and verify your doctors first.

Open Enrollment • 2026 Deadlines • Written by Robert Adams

Open Enrollment 2026: Last Day for Jan 1 Coverage Is Dec 15 — Don’t Miss It

The 2026 window runs Nov 1 → Jan 15. Enroll by Dec 15 for a Jan 1 start, or by Jan 15 for a Feb 1 start. Prices are up in many ZIPs, so compare Marketplace vs. Private PPO (if eligible) before you lock in the wrong plan.

Key 2026 dates

- Nov 1: Open Enrollment starts.

- Dec 15: Deadline for Jan 1 coverage.

- Jan 15: Final day to enroll for a Feb 1 start.

Am I eligible for savings?

Most households qualify for some level of credit on Marketplace plans based on income, household size, and ZIP. We’ll run the numbers and show your net premium—then compare against a private, medically underwritten PPO if you’re eligible (often lower premiums for healthy applicants).

- • Can be cheapest if you qualify for credits.

- • Many plans are HMO/EPO; referrals are common.

- • Credits reconcile at tax time.

- • County/ZiP options vary, networks differ.

- • Often no referrals; broader networks.

- • Pricing isn’t tied to ACA credits.

- • Great fit when keeping doctors/hospitals matters most.

What to do right now (5 minutes)

1) Send basics

ZIP, ages, household/income range.

2) List doctors & meds

We verify networks + prescriptions.

3) Compare 3 paths

Marketplace • Private PPO • COBRA exit if needed.

Beat the Dec 15 cutoff for Jan 1 start.

We’ll show your net premium with credits, verify your doctors, and stack it against a Private PPO if you’re eligible.

Quick FAQs

What happens if I miss Dec 15?

You can still enroll by Jan 15 for a Feb 1 start. After that, you’ll need a Qualifying Life Event—or see if a Private PPO is available.

Will my doctors be in network?

We verify your providers and prescriptions for both paths before you enroll.

Are Private PPOs cheaper?

For healthy households that qualify, they can be competitive vs. unsubsidized Marketplace plans. We’ll show both.

Robert Adams

RKA Insurance Advisors • 561-806-9913 • robert@rkainsuranceadvisors.com