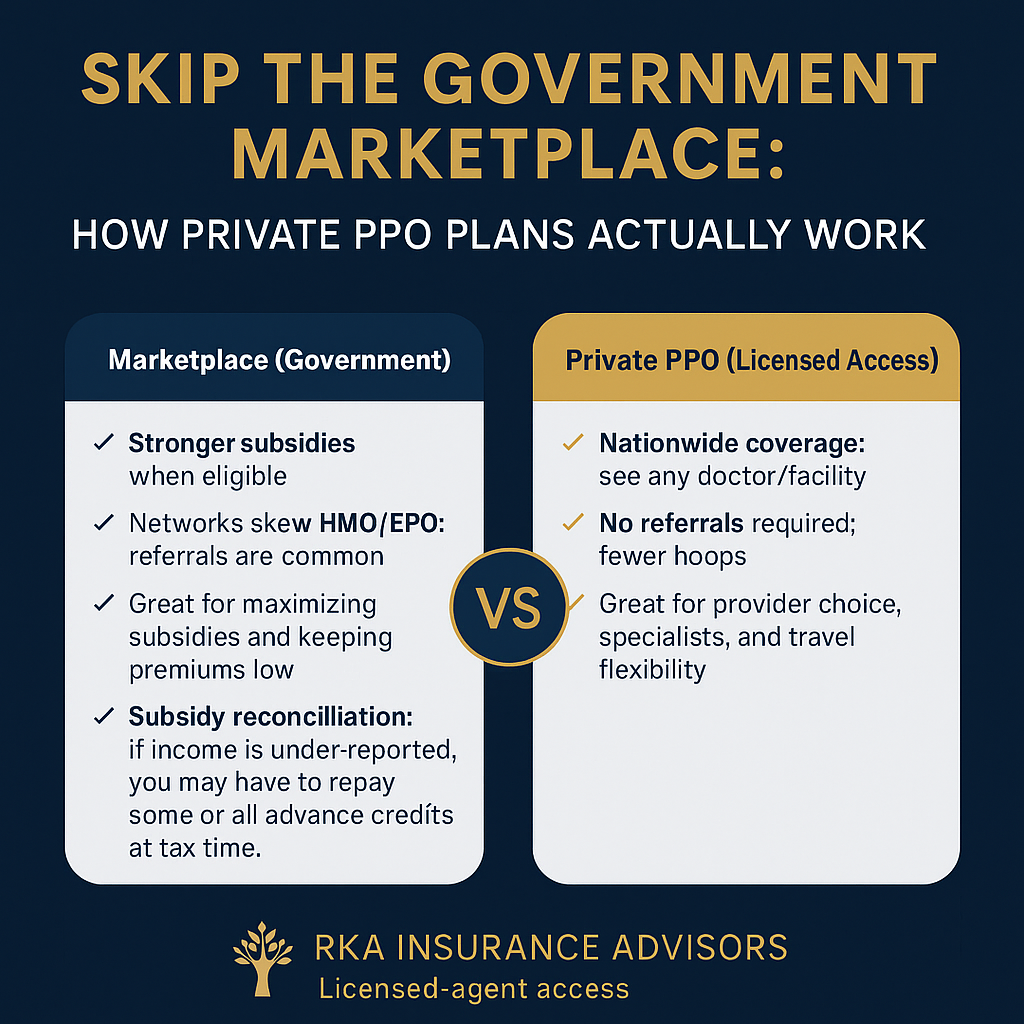

Skip the Government Marketplace: How Private PPO Plans Actually Work

Fast guide to non-Marketplace Private PPOs—how they bill, who they fit, and what to verify first. We’ll confirm your doctors, compare options, and show clear costs.

Skip the Government Marketplace: How Private PPO Plans Actually Work

Prefer private, licensed-access coverage? Here’s the fast, practical guide—what it is, how it bills, and how to check if it fits your doctors, travel, and budget.

Why some people skip the Marketplace

- Keep specific doctors/hospitals. Many Marketplace options are HMO/EPO with referrals.

- Travel flexibility. Want nationwide, not just local networks.

- Fewer gatekeepers. Prefer no referrals for specialists or imaging.

- Income too high for meaningful subsidies—or you don’t want tax-credit involvement.

- If your income qualifies, Marketplace can be the cheapest route.

- Credits reconcile on your tax return; under-reporting income can create payback.

- Private PPOs skip subsidies entirely—pricing is based on age, ZIP, benefits, and network.

How Private PPO actually works

- Nationwide PPO access in eligible networks—keep your specialists and preferred hospitals.

- No referrals for specialists (typical), fewer hoops to schedule care.

- Enroll through a licensed agent; options vary by state and carrier.

- Premiums aren’t tied to ACA income credits.

- Your exact doctors and facilities are in-network (we check for you).

- Copays vs coinsurance on high-ticket items (imaging, outpatient surgery).

- Prescription tiers and any prior-auth on key meds.

- Out-of-pocket maximum is a number you can live with.

What drives price (non-subsidized)

The big levers

- Age rating for adults; kids usually add less than another adult.

- ZIP/county + network breadth.

- Deductibles, coinsurance, copays, and the out-of-pocket max.

Ways to keep it efficient

- Don’t overbuy—match benefits to how you actually use care.

- Choose networks that include your real providers (not just brand names).

- Use generics when clinically appropriate; we’ll check formulary tiers.

Who typically chooses Private PPO

Strong fit

- Self-employed/1099 families who want broad doctor choice.

- Frequent travelers or multi-state households.

- People who dislike referral bottlenecks.

Maybe not a fit

- Households whose main goal is max subsidies and the lowest possible premium.

- Anyone who does not have specific providers to keep and rarely needs out-of-area care.

Want the best non-Marketplace fit in your ZIP?

We’ll verify your doctors and meds, compare PPO options, and show clear costs. No pressure—just answers.

FAQ

Are Private PPOs the same as Marketplace plans?

Do Private PPOs need referrals?

Will I owe taxes if I’m not using subsidies?

How do I know if my doctor is covered?

How do we start?

This overview is educational, not tax or legal advice. Plan availability and rules vary by state and carrier. Eligibility and enrollment subject to underwriting/plan terms where applicable.

Telemedicine Benefits: Save Time, Cut Costs, and Skip the Waiting Room | RKA Insurance Advisors

See a clinician by phone or video—often at $0 copay. When telemedicine works best, what’s covered, and how to get plans with $0 virtual visits.

Health Guides • Updated • Written by Robert Adams

Telemedicine Benefits: Faster Care, Lower Cost, Less Hassle

Fast take:

Telemedicine lets you meet with board-certified clinicians by phone or video, usually in minutes. It’s great for common issues, refills, and follow-ups—often at $0 copay on many plans. You save time, avoid waiting rooms, and cut costs without sacrificing quality.

- • See a clinician from home, work, or travel—no waiting room.

- • Perfect for minor illnesses, refills, and quick follow-ups.

- • Visits typically run ~15 minutes.

- • Fewer germ exposures vs. urgent care/ER waiting areas.

- • Helpful for immunocompromised, pregnant, and elderly.

- • Triage contagious symptoms before in-person care.

- • Family, internal, and pediatrics: easy follow-ups and check-ins.

- • Manage hypertension, diabetes, asthma, mental health, more.

- • Many platforms offer 24/7 access.

- • Many plans cover telehealth at $0 or low copay.

- • Cash-pay telehealth is typically cheaper than in-office rates.

- • Using telehealth for non-emergencies avoids costly ER bills.

Good uses vs. go in-person

Use telemedicine for

- Cold/flu, sore throat, sinus/ear issues

- Minor skin rashes, pink eye

- Medication refills & follow-ups

- Mild GI upset

Go in-person for

- Chest pain, severe shortness of breath

- Serious injury, heavy bleeding

- Neurologic symptoms (stroke signs)

- Anything emergent → ER

Want $0-copay telehealth on your plan?

We’ll verify your network, show real costs, and compare Marketplace vs. Private PPO options for your ZIP.

Quick FAQs

Is telemedicine covered?

Many plans cover telehealth at 100% for non-emergency visits. We’ll confirm your exact copay and vendors.

Can telehealth prescribe meds?

Yes—for appropriate conditions. Controlled substances typically require in-person evaluation per state rules.

Does telehealth replace my PCP?

No. It complements primary care and urgent care for quick, non-emergency needs.

Robert Adams

RKA Insurance Advisors • Private & Marketplace Health Coverage • 561-806-9913 • robert@rkainsuranceadvisors.com