Why PPOs Are King: The Case for Nationwide Networks and Provider Freedom

Why PPOs beat HMOs for self-employed professionals, business owners, and frequent travelers: nationwide networks, no primary care gatekeepers, direct specialist access, and fewer authorization delays.

Why PPOs Are King: The Case for Nationwide Networks and Provider Freedom

Fast take: If you're self-employed, travel for work, or value direct access to specialists without referral red tape, PPO networks offer unmatched flexibility. No primary care gatekeepers, no waiting weeks for authorization, and coverage that works wherever you are—not just in your home county.

Tired of narrow HMO networks and referral requirements?

We'll show you nationwide PPO options and verify your doctors are covered—no restrictions, no runarounds.

Get Free Quotes Book a CallWhat makes PPO networks different

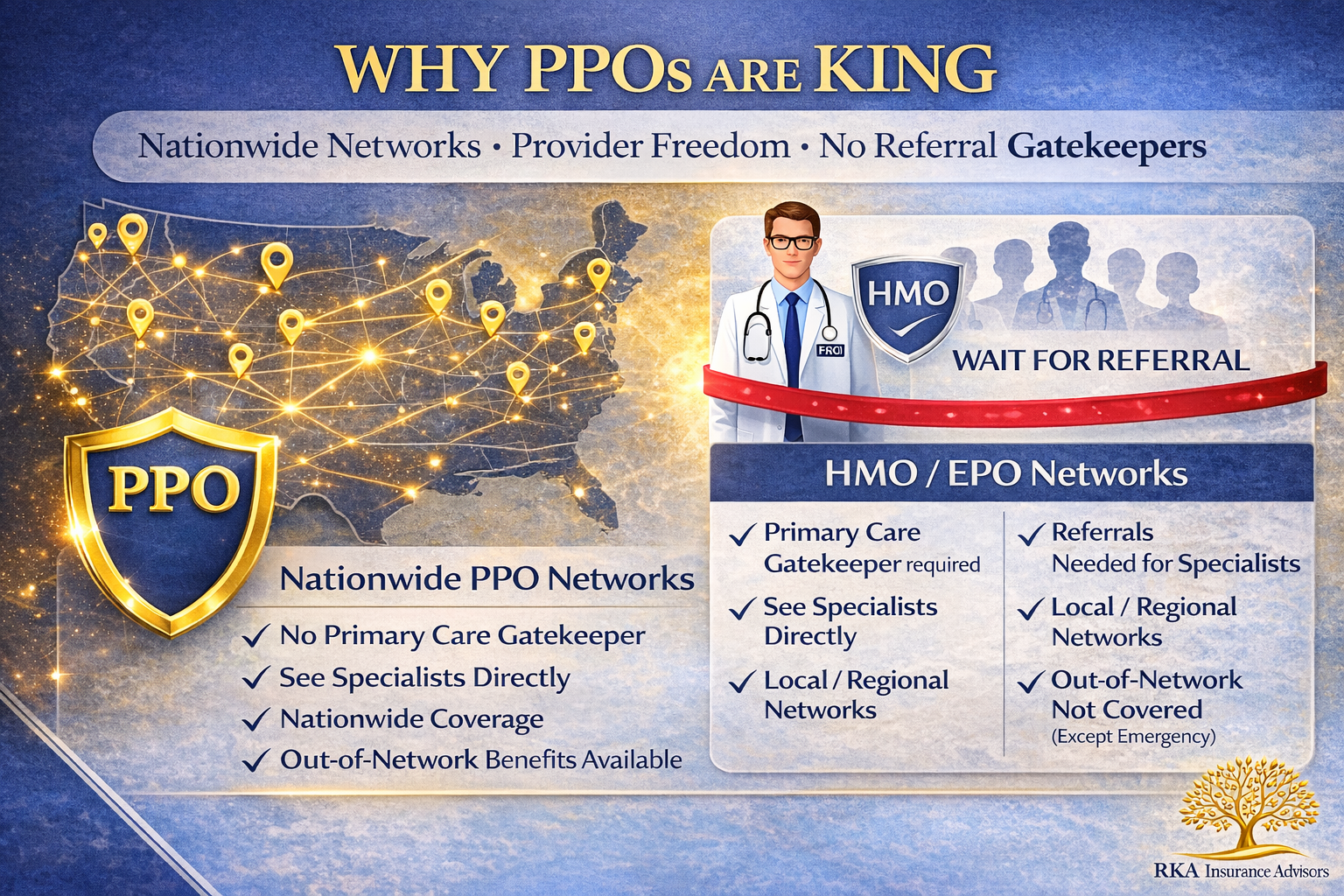

HMO/EPO (Most Marketplace plans)

✗ Primary care doctor required (PCP)

✗ Referrals needed for specialists

✗ Limited to local network only

✗ Out-of-network = not covered (except emergencies)

✗ Authorization delays common

PPO (Preferred Provider Organization)

✓ No primary care gatekeeper required

✓ See specialists directly—no referrals

✓ Nationwide network coverage

✓ Out-of-network benefits available

✓ Fewer authorization requirements

Who benefits most from PPO networks

Business owners & entrepreneurs

✓ Client meetings across multiple states

✓ Need care wherever business takes you

✓ Can't afford delays waiting for referrals

✓ Want specialist access without bureaucracy

Frequent travelers

✓ Snowbirds splitting time between states

✓ Digital nomads working remotely

✓ Families with second homes

✓ Need consistent coverage anywhere

People with specific provider needs

✓ Established relationship with specialist

✓ Prefer specific hospitals or facilities

✓ Need access to top-tier medical centers

✓ Don't want to change doctors

High-income households

✓ Don't qualify for meaningful ACA subsidies

✓ Paying full price either way

✓ Want maximum flexibility and choice

✓ Prefer premium networks and providers

Real-world scenarios where PPOs win

Scenario 1: The entrepreneur in pain

HMO path: Back pain → see PCP first → wait for referral → wait for specialist appointment → weeks of delays

PPO path: Back pain → call orthopedist directly → appointment this week → faster treatment

Scenario 2: The traveling consultant

HMO path: Urgent care needed in Dallas → not in network → pay full cost out-of-pocket → file claim, hope for reimbursement

PPO path: Urgent care in Dallas → nationwide network → normal copay → done

Scenario 3: The specialist relationship

HMO path: Your cardiologist isn't in network → forced to switch doctors → rebuild relationship from scratch

PPO path: Your cardiologist is in nationwide PPO → keep your doctor → continuity of care

Scenario 4: The imaging authorization

HMO path: Doctor orders MRI → need authorization → wait 5-7 business days → delay diagnosis

PPO path: Doctor orders MRI → schedule immediately → faster diagnosis and treatment

The hidden costs of HMO restrictions

Many people choose HMOs to save on monthly premiums, but the total cost equation includes more than just what you pay each month:

Time costs

✗ Waiting for PCP appointments before specialist referrals

✗ Authorization delays (5-7 days common for imaging/procedures)

✗ Extended treatment timelines due to referral requirements

✗ Lost productivity from delayed care

Out-of-pocket surprise costs

✗ Traveling for work? Out-of-network urgent care = full cost

✗ Emergency room in another state = potential balance billing

✗ Preferred specialist not in network = start over with new doctor

✗ Lab work at non-contracted facility = surprise bills

PPO networks for self-employed professionals

If you're self-employed, your health insurance needs are different from W-2 employees:

You can't afford downtime

No paid sick leave. Every day you're delayed waiting for referrals or authorizations is lost income. PPOs let you see specialists immediately and get treatment faster.

Your work location varies

Client sites, conferences, remote work from different states—you need coverage that travels with you, not just in your home county.

You control your own schedule

Don't waste time scheduling PCP visits just to get a referral. See the specialist directly and get back to work.

You're paying full freight anyway

If you don't qualify for subsidies, you're paying full price for ACA plans. PPO premiums are often comparable with far better access.

Common PPO myths debunked

❌ Myth: PPOs are always more expensive

Reality: For healthy applicants who don't qualify for subsidies, private underwritten PPOs often cost less than unsubsidized ACA plans—with better networks and lower deductibles.

❌ Myth: You don't need nationwide coverage

Reality: Even if you rarely travel, emergencies happen. Car accident on vacation? Family emergency out of state? Nationwide PPO coverage eliminates surprise bills.

❌ Myth: Referrals aren't a big deal

Reality: Referral requirements add 1-3 weeks to every specialist visit. For time-sensitive issues or busy professionals, this delay is costly.

❌ Myth: All PPOs are the same

Reality: PPO network size varies dramatically. We verify your specific doctors are in-network before you enroll—not all "nationwide" PPOs include every provider.

When to choose PPO over HMO/EPO

Choose PPO if...

✓ You're self-employed or own a business

✓ You travel frequently for work or personal reasons

✓ You have established relationships with specialists

✓ You don't qualify for meaningful ACA subsidies

✓ You value direct access without referral delays

✓ Time is money and you can't afford bureaucratic delays

HMO/EPO might work if...

✓ You qualify for strong ACA subsidies

✓ All your doctors are in a local HMO network

✓ You rarely travel and don't need out-of-area care

✓ You're comfortable with PCP gatekeeping

✓ You don't mind waiting for referrals and authorizations

✓ Lowest monthly premium is your only priority

How RKA finds the right PPO for you

Doctor verification first

We check your specific doctors, specialists, and hospitals against actual PPO networks—not just "find-a-doc" directories that are often outdated.

Multi-state coverage mapping

Travel between Florida and New York? We verify both locations have strong network coverage before you commit.

Total cost comparison

We model premiums + deductibles + expected usage for HMO vs PPO options—sometimes PPO costs less when you factor in out-of-network exposure.

Private vs Marketplace PPO options

Marketplace has limited PPO options. We compare against private underwritten PPOs that may offer better networks and lower deductibles.

Ready for nationwide PPO freedom?

We'll verify your doctors, compare PPO options, and show you total costs—no referral requirements, no network restrictions.

Get Free Quotes Book a CallQuick FAQs

Are PPOs available on the ACA Marketplace?

Some states offer limited PPO options on the Marketplace, but many areas only have HMO/EPO plans. Private underwritten PPOs (off-exchange) often offer broader networks and better benefits for healthy applicants.

Do PPOs really cost that much more than HMOs?

For subsidized plans, yes. But if you don't qualify for subsidies, private PPO premiums are often comparable to unsubsidized HMO/EPO plans—with far better access and lower deductibles.

What does "nationwide PPO" actually mean?

Network coverage in all 50 states (or most states). Specific provider availability varies—we verify your doctors are included, not just that the network exists in your state.

Can I switch from HMO to PPO mid-year?

ACA plans can only switch during Open Enrollment (or with a qualifying event). Private PPOs are available year-round if you qualify for underwriting.

For education only; network access and benefits vary by carrier and state. Always verify providers before enrollment. Eligibility for private underwritten plans subject to medical underwriting.